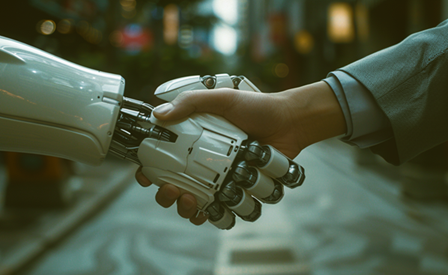

In today’s rapidly evolving business landscape, the integration of artificial intelligence (AI) and humans approach has become crucial for success. While AI offers efficiency, speed, and data-driven insights, human intuition, creativity, and empathy bring a unique value that machines alone cannot replicate. Combining these strengths can lead to a powerful synergy that drives innovation, growth, and customer satisfaction. Here are key strategies to successfully blend AI and human approaches in business:

Define Clear Objectives: Start by defining clear objectives for integrating AI into your business processes. Determine areas where AI can enhance efficiency, such as data analysis, customer service automation, or predictive modeling. Simultaneously, identify areas where human input is indispensable, such as decision-making, creativity, and relationship-building.

Collaborative Workflows: Foster collaborative workflows that leverage AI’s capabilities while empowering human expertise. For example, use AI algorithms to analyze vast amounts of data and generate insights, which humans can then interpret and apply strategically. Create feedback loops where AI learns from human feedback and vice versa, continually improving outcomes.

Human-Centric Design: Prioritize human-centric design in AI applications to ensure they align with user needs and preferences. Consider factors like usability, transparency, and ethical considerations to build trust and acceptance among users. Incorporate user feedback iteratively to refine AI solutions and enhance user experience.

Augmented Intelligence: Embrace the concept of augmented intelligence, where AI augments human capabilities rather than replacing them. AI can assist humans in making better decisions by providing data-driven recommendations, automating repetitive tasks, and uncovering patterns that humans might overlook. This approach leverages the strengths of both AI and humans for optimal results.

Continuous Learning: Foster a culture of continuous learning and upskilling for both AI systems and human employees. Keep AI algorithms updated with the latest data and technologies to maintain accuracy and relevance. Provide training and development opportunities for employees to enhance their AI literacy, collaboration skills, and adaptability to technological advancements.

Ethical Considerations: Address ethical considerations related to AI integration, such as data privacy, bias mitigation, and fairness. Implement robust data governance practices, ensure algorithmic transparency, and regularly audit AI systems for biases. Engage diverse teams in AI development and decision-making to mitigate unintended consequences and promote inclusivity.

Customer-Centric Approach: Maintain a customer-centric approach throughout AI integration efforts. Use AI to personalize customer experiences, anticipate needs, and deliver proactive solutions. Combine AI-driven insights with human empathy and communication skills to build strong relationships with customers and enhance brand loyalty.

Measure Impact: Establish metrics to measure the impact of AI-human collaboration on business outcomes, such as productivity gains, cost savings, customer satisfaction scores, and innovation metrics. Monitor key performance indicators (KPIs) regularly and adjust strategies based on insights to maximize the value generated from AI-human synergies.

By implementing these strategies, businesses can achieve the perfect blend of AI and human approaches, unlocking new levels of efficiency, innovation, and customer satisfaction in today’s competitive landscape.

Who we are: Funded.com is a platform that is A+ BBB accredited over 10+ years. Access our network of Angel Investors, Venture Capital or Lenders. Let us professionally write your Business Plan.